Introduction

The recent rise of ransomware, attacks on supply chains and increasing costliness of privacy regulations has made cyber insurance an important topic of discussion. But it can be tricky to keep up with cyber insurance requirements. One of the most robust ways to meet those requirements is with multi-factor authentication (MFA). MFA provides an additional layer of protection by requiring users to provide multiple authentication factors, significantly reducing the risk of unauthorized access and thwarting cyberattacks. The security benefits of MFA astronomically boost your ability to secure the best cyber insurance for your needs.

Multi-Factor Authentication

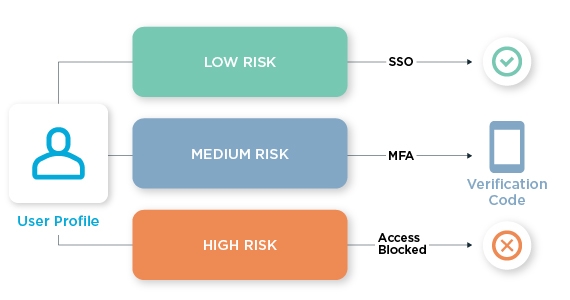

Multi-factor authentication (MFA) plays a vital role in the context of a cyber insurance program. This security mechanism adds an extra layer of protection to verify the identity of users attempting to access sensitive systems or data. MFA requires individuals to provide at least two different forms of authentication factors, such as something they know (i.e., password or PIN), something they have (i.e., a security token or smartphone), or something they are (i.e., biometric data like fingerprints or facial recognition). By combining these factors, MFA significantly reduces the risk of unauthorized access and helps prevent identity theft, data breaches and other cyberattacks.

Multi-factor authentication is an incredibly powerful tool against certain types of attacks. The famous Google-NYU-UCSD research showed that push-to-authenticate stopped 100 percent of automated attacks, 99 percent of bulk phishing attacks and 90 percent of targeted attacks. Microsoft came to the same conclusion: adding factors to weak passwords provides excellent defense, reducing the likelihood of account takeover by a staggering 99.9 percent.

By implementing MFA, organizations can ensure that only authorized individuals with legitimate credentials can gain access to critical systems and sensitive data, as even if a password is compromised, the attacker would still need access to a second authentication factor. This extra layer of security makes it much more challenging for hackers to infiltrate an organization's network or systems.

MFA can also positively impact an organization's risk profile. Insurers often assess the security measures and practices implemented by organizations before underwriting a cyber insurance policy. By implementing MFA and showcasing a mature IAM system, organizations can strengthen their case for obtaining comprehensive cyber insurance coverage and potentially enjoy cost savings in the process.

How to choose:

When choosing an MFA solution, there are three main factors to consider:

- Security Features: The primary purpose of implementing MFA is to enhance security and protect sensitive information. Look for features like strong authentication methods (such as biometrics and passwordless), support for adaptive authentication and integration with other security solutions like Single Sign-On (SSO) or Identity and Access Management (IAM) platforms. Additionally, consider whether the solution supports industry-standard protocols like OAuth, SAML, or OpenID Connect.

- User Experience: While security is key, it is equally important to consider the user experience when choosing an MFA solution. Look for an MFA solution that offers a frictionless user experience as well as self-service options that allow users to manage their own MFA settings and troubleshoot issues without extensive IT support.

- Scalability and Integration: Evaluate whether the MFA solution can accommodate your user base and handle increased authentication traffic without performance degradation. Additionally, check if the MFA solution integrates well with your existing IT infrastructure, applications, and identity management systems.

- Other factors to consider might include compliance with regulatory requirements such as GDPR or HIPAA, availability of reporting and auditing capabilities and vendor reputation and support.

Conclusion

Protecting your organization from cybercrime is a top priority, and cyber insurance is one of the best ways to do it. By implementing MFA in your cyber insurance program, you can guarantee insurers that your risk levels are low, enabling your protection against cybercrime, and getting you the best coverage at the most affordable premiums.

For a complete view of why IAM matters in the context of cyber insurance, see read our in-depth guide. Also, check out our comprehensive guide to cyber insurance and IAM.